“Weekend Content for New Financial Planners” is a collection of podcasts, articles, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. This installment begins with two articles from New Planner Recruiting’s co-founder Caleb Moore. Moore provides tips on how to handle a downmarket for both job seekers and firms (as a new advisor or career-changer, “seeing” the employer’s perspective can be especially helpful). Given the turbulent markets amid the pandemic, we next look at a couple of investing-related articles. The first comes from The Wall Street Journal’s Jason Zweig covering how the market collapse and economic slowdown affect the human brain (relevant,…

-

-

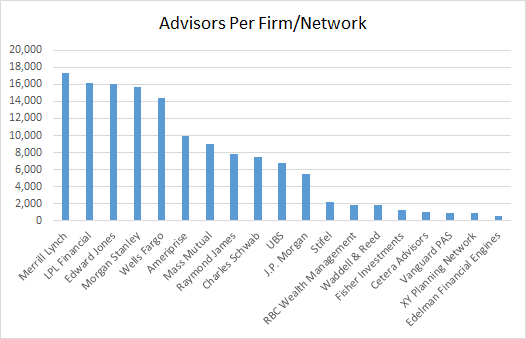

Industry Insights: Industry Players by Advisor Headcount

“Industry Insights” covers trends and topics within the financial planning industry. *** When first starting out in the industry, you may be curious about which firms are the dominant players. Sure, you are probably familiar with the big names like Merrill Lynch and Wells Fargo, but quantifying their role – and impact – in the market is a bit different. There are a variety of ways to measure market position, of course. Today we look at how firms stack up by advisor headcount. Total advisor estimates vary rather widely. Cerulli Associates estimates there are around 300,000 financial advisors in the United States. Michael Kitces recently explained why this figure is…

-

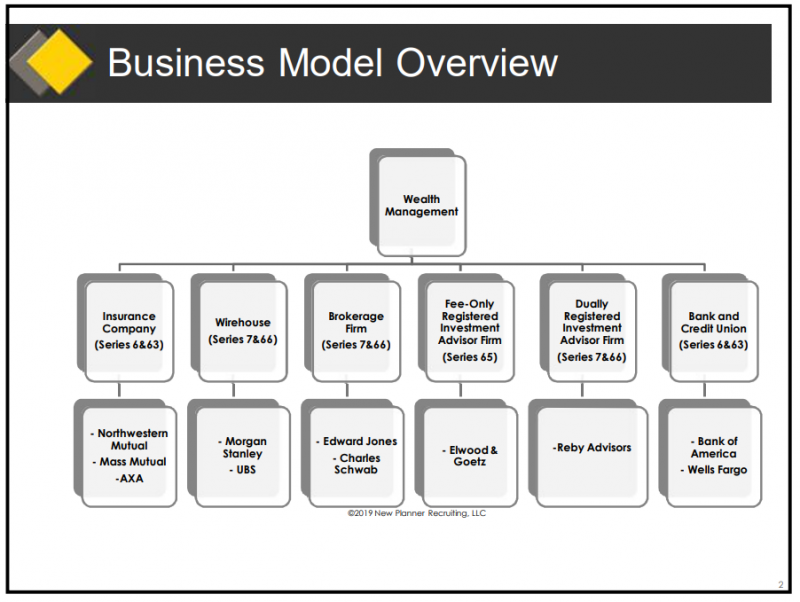

Industry Insights: Licenses Needed for Each Type of Business Model

“Industry Insights” covers trends and topics within the financial planning industry. *** We continue our look at some of the fundamental aspects of the financial services industry. Last week, New Planner Recruiting hosted an informational webinar covering tips for getting hired as a new planner. One of the slides did a good job summarizing the industry’s business models while including some of the big-name firms within some of the models. In addition, the slide addresses a frequent source of confusion for many new to the industry – which licenses are needed for each model: While certain licenses may be better-known to industry newcomers, they may simply not be needed depending…

-

Industry Insights: Differences Between Broker-Dealers and RIA Firms

“Industry Insights” covers trends and topics within the financial planning industry. *** It can be a challenge to understand the basic models of financial planning firms. Terms and acronyms like broker-dealers, IBDs, wirehouses, and RIAs can quickly become confusing. To add some clarity, let’s take a closer look at some key differences when considering the two primary models: broker-dealers and RIAs (Registered Investment Advisors). Broker-dealer is the term for entities that trade securities for their customers (brokering) or for their own account (dealing). Those who get their start with broker-dealers have to become registered representatives (through industry licensing). Registered representatives are paid on the basis of product commissions and must recommend…

-

Industry Insights: Stock Market Participation Rates

As I was continuing my Certified Financial Planning™ coursework to satisfy the CFP® education requirement, I came across an investing statistic I found interesting (and a bit concerning). Per Gallup’s annual Economic and Personal Finance survey, only 54% of U.S. adults report having money invested in stocks in some form (directly or through a fund). This figure was higher before the 2008 financial crisis – 62% – but that still seems low. For folks considering whether to enter financial planning (or financial coaching), this appears to be yet another data point showing that there is room for improvement.

-

Industry Insights: Employment Outlook for Financial Advisors

“Industry Insights” covers trends in the financial planning industry. *** As has been the case for several years now, the outlook for financial advisors appears rather favorable. According to the Occupational Outlook Handbook: “Employment of personal financial advisors is projected to grow 15 percent from 2016 to 2026, much faster than the average for all occupations…Job prospects for personal financial advisors should be relatively favorable, compared with prospects in other financial sector occupations. Those who obtain certification will likely have the best prospects.” Of course, the thought has been that robo-advisors will take some jobs. The OOH continues: “The emergence of “robo-advisors,” computer programs that provide automated investment advice based…