“Industry Insights” covers trends and topics within the financial planning industry.

***

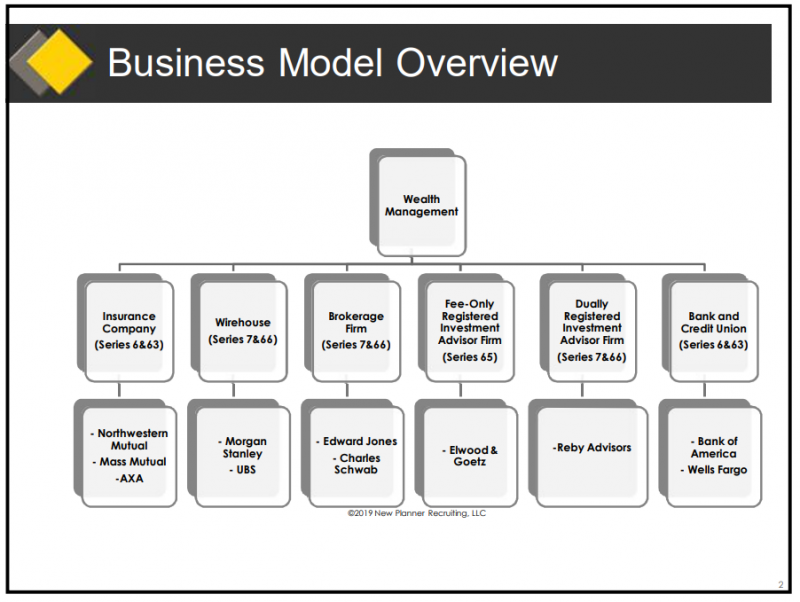

It can be a challenge to understand the basic models of financial planning firms. Terms and acronyms like broker-dealers, IBDs, wirehouses, and RIAs can quickly become confusing.

To add some clarity, let’s take a closer look at some key differences when considering the two primary models: broker-dealers and RIAs (Registered Investment Advisors).

Broker-dealer is the term for entities that trade securities for their customers (brokering) or for their own account (dealing). Those who get their start with broker-dealers have to become registered representatives (through industry licensing). Registered representatives are paid on the basis of product commissions and must recommend “suitable” products.

RIAs, on the other hand, are firms that must meet a fiduciary standard. Folks who get their start here must pass the Series 65 exam.

To shed light on the client relationship, we turn to an excerpt from Michael Kitces’ article outlining why registered representatives of broker-dealers can’t technically be fiduciaries:

“Here’s why that matters from the perspective of this question being a fiduciary to your client… because when it’s not your client – it’s the broker dealer’s client and you work as a sales rep for your broker dealer’s products – legally, your duty is not to the client. It actually can’t be. Your duty is to the broker-dealer that you represent.

That’s why when you leave a broker-dealer, you can’t take your client information with you. You can’t take your client files. You can’t take the financial plans. You can’t even take a list of their account numbers. At best, the broker protocol only allows you to take basic names and contact information. And really, that’s just because you can look it up online anyway at this point! It’s barely private information!”

As you can see, your capacity in a broker-dealer is more akin to a sales representative with a duty to the broker-dealer. This is in contrast with RIA firms who have a duty to the client and must meet a fiduciary standard.