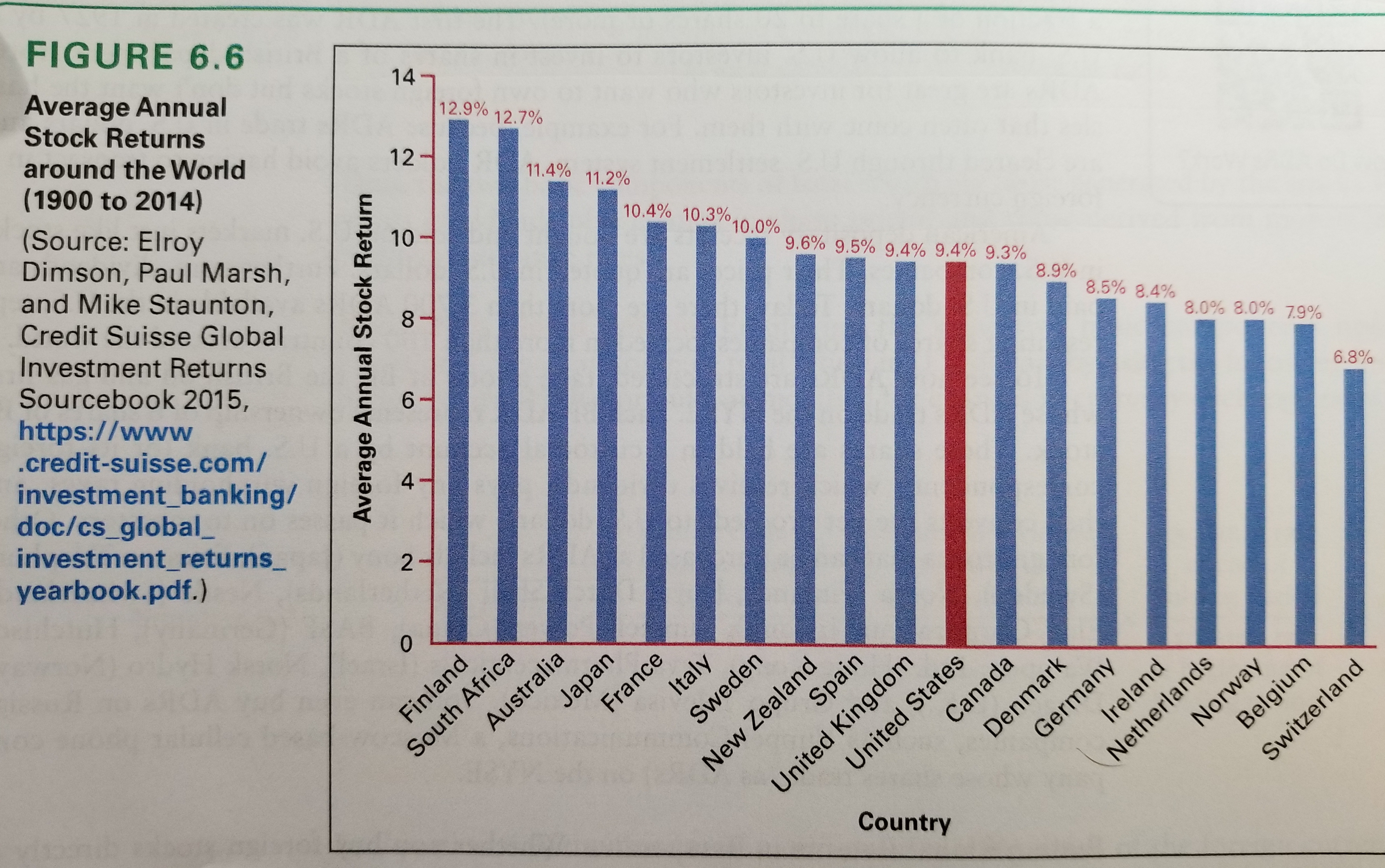

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns. As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market. When considering foreign equities, which are the…

-

-

Industry Insights: Differences Between Broker-Dealers and RIA Firms

“Industry Insights” covers trends and topics within the financial planning industry. *** It can be a challenge to understand the basic models of financial planning firms. Terms and acronyms like broker-dealers, IBDs, wirehouses, and RIAs can quickly become confusing. To add some clarity, let’s take a closer look at some key differences when considering the two primary models: broker-dealers and RIAs (Registered Investment Advisors). Broker-dealer is the term for entities that trade securities for their customers (brokering) or for their own account (dealing). Those who get their start with broker-dealers have to become registered representatives (through industry licensing). Registered representatives are paid on the basis of product commissions and must recommend…

-

Financial Planning Articles (January 11, 2019)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning, industry trends, career development, and more. *** This installment features a heavy dose of personal and career development articles from both Michael Kitces at Kitces.com and Shane Parrish at Farnam Street. Kitces explains why what may feel like “paying your dues” as a new advisor is really just a necessary aspect of learning the skills of the profession. His second article reviews strategies for satisfying the CFP Board experience requirements as a career changer. Parrish’s articles cover productivity (and doing less in order to do more) and learning how to learn and better…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 1)

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** When designing portfolios, one of the primary issues is defining, measuring, and allocating risk. The traditional approach to risk management separates risks into two worlds: systematic and unsystematic risk. What exactly do these risks entail? Systematic risks are risks that investors accept by simply investing in the system. In other words, these are market risks that cannot be diversified away. Systematic risks include such negative events as wars, natural disasters, and other similar unexpected events. If you’ve ever heard of the term Beta,…