“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health.

***

When designing portfolios, one of the primary issues is defining, measuring, and allocating risk. The traditional approach to risk management separates risks into two worlds: systematic and unsystematic risk.

What exactly do these risks entail?

Systematic risks are risks that investors accept by simply investing in the system. In other words, these are market risks that cannot be diversified away. Systematic risks include such negative events as wars, natural disasters, and other similar unexpected events.

If you’ve ever heard of the term Beta, this is the metric that measures an investment’s price volatility as it corresponds to the overall market’s volatility. As such, it represents a key measure of systematic risk.

On the other hand, unsystematic risks (or nonsystematic) are risks specific to an investment. For example, for an individual stock, unsystematic risks might include financial, management, regulatory, or competitive risks.

In contrast to systematic risks, unsystematic risks can be greatly diversified away by investing across a variety of asset classes. Standard deviation of an investment’s returns is typically used to measure unsystematic risk.

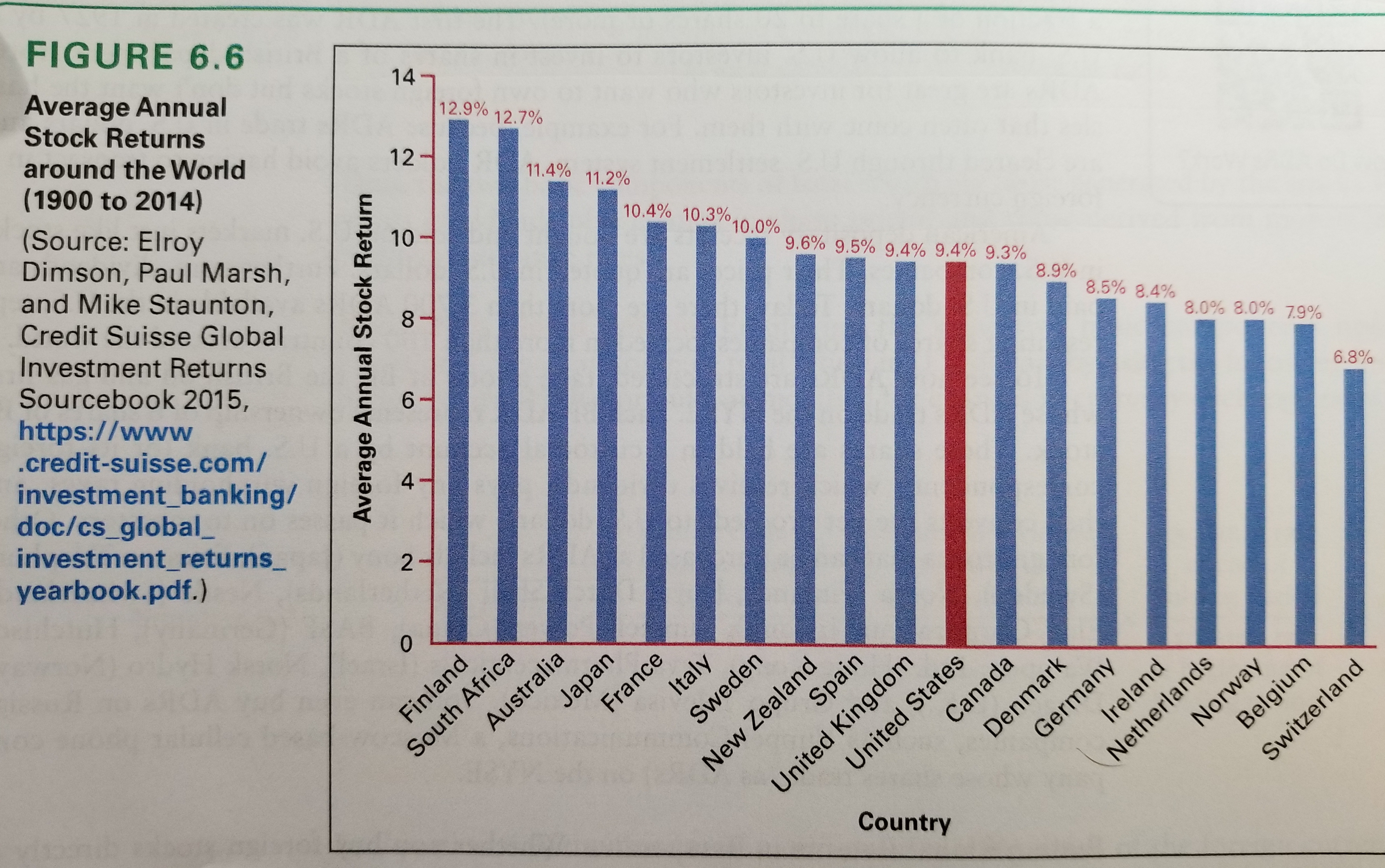

The Need for Financial Planning: One reason investors improperly manage risk in their portfolios is because of what is called home-country bias. Home-country bias results from investors being more comfortable with investing in domestic assets and therefore overweighting them in their portfolio. In the U.S., for example, investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market.