“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health.

***

Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns.

As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market.

When considering foreign equities, which are the primary markets and how have their returns compared to the United States?

“Today the world equity markets are dominated by just six markets, which together account for about 75% of the global total. the United States, by far, has the biggest equity market, which in 2015 had a total value approaching $27 trillion. China is in second place with nearly $8 trillion in total equity market value, and if you include the Hong Kong Exchanges, then China’s total is more than $11 trillion. Japan is in third place with nearly $5 trillion and is followed by Euronext, which includes exchanges in Belgium, France, the Netherlands, Portugal, and the United Kingdom. The last of the markets valued about $3 trillion is India with its two major exchanges. Other equity markets worth more than $1 trillion can be found in Canada, Germany, Switzerland, Australia, and Korea.”

Source: “Fundamentals of Investing” 13th Edition, Smart, Gitman, & Joehnk

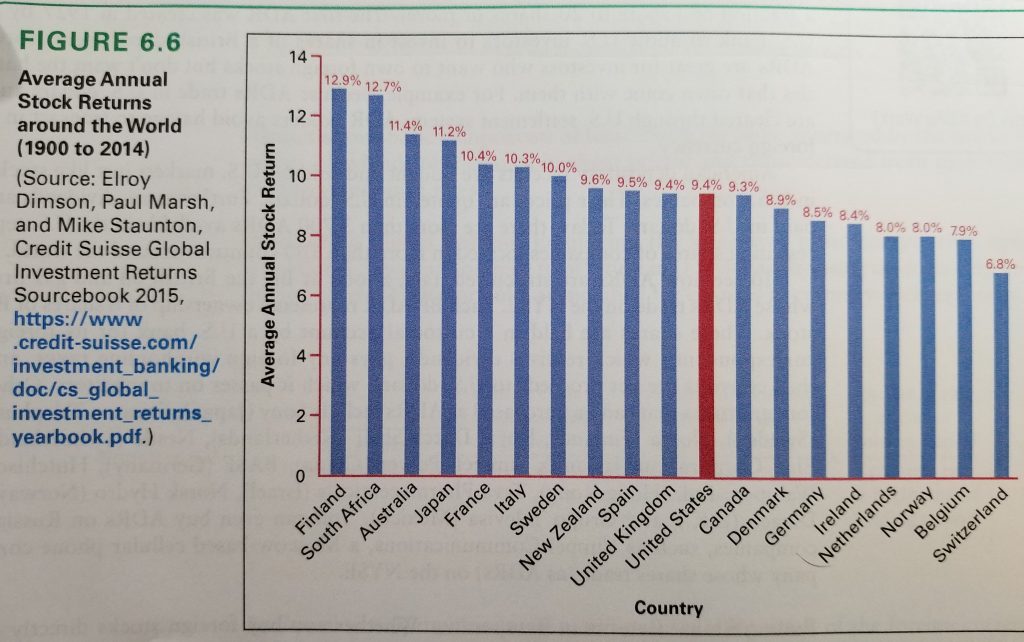

While there are plenty of sizable equity markets around the world, let’s take a look at their respective returns:

Source: “Fundamentals of Investing” 13th Edition, Smart, Gitman, & Joehnk

A quick look at this chart shows the United States falls in the middle of the pack with regards to average annual stock returns (though still at a very respectable 9.4%). Of course, the higher-returning countries are not without their own risks. But we can see how a internationally-diversified portfolio can reduce unsystematic risks while providing the possibility for higher returns.