“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. A tweet from Michael Kitces over the weekend about Northwestern Mutual’s latest survey caught my eye: 20% is a pretty significant chunk of these consumers looking for an advisor for the first time(!). The XY Planning Network‘s advisors seem poised to best service this new influx of prospective clients. They have built their fee-only compensation model (monthly retainer vs. AUM-only) to specifically serve these generations. And while experiencing huge growth since its launch in 2014 (30 members its first year), XYPN’s total advisor count…

-

-

Weekend Content for New Financial Planners (March 28, 2020)

“Weekend Content for New Financial Planners” is a collection of podcasts, articles, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. This installment begins with two articles from New Planner Recruiting’s co-founder Caleb Moore. Moore provides tips on how to handle a downmarket for both job seekers and firms (as a new advisor or career-changer, “seeing” the employer’s perspective can be especially helpful). Given the turbulent markets amid the pandemic, we next look at a couple of investing-related articles. The first comes from The Wall Street Journal’s Jason Zweig covering how the market collapse and economic slowdown affect the human brain (relevant,…

-

The Need For Financial Planning: Retirement Shortfall

The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** After finishing a final exam for my Income Tax Planning course (woohoo!) last week, I began my Retirement Planning and Employee Benefits course. While my previous studies have touched on retirement planning (CFA® examinations and Series 7), this course goes a lot deeper into the nuances of tax-advantaged accounts. The retirement planning material actually grabs your attention right off the bat, so much so that I felt a revival of this “The Need for Financial Planning” series was due. I was certainly aware…

-

The Need for Financial Planning: The New “QBI” Deduction

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** As we recently covered, the new tax law titled the Tax Cut Jobs Act brought in the most significant changes to tax planning in several decades. These big changes bring the need for advisor guidance in helping clients navigate the new rules. One of the more significant parts of the new law is a new deduction for business owners. Dubbed the Section 199A deduction, or QBI (Qualified Business Income) deduction, its purpose is to maintain the tax benefit (no double taxation) that certain…

-

The Need for Financial Planning: Tax Cut Jobs Act Guidance

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Since its passing in late 2017, you have probably heard of the Tax Cut Jobs Act (or TCJA). With tax season in full swing, you have probably seen it being mentioned even more frequently. But perhaps you’ve always had your tax professional handle all of your matters and aren’t really sure of the new law’s significance. As prospective financial planners, the passage of TCJA cannot be understated. Major changes to the tax law do not come around very frequently. The last? 1986 (!).…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 2)

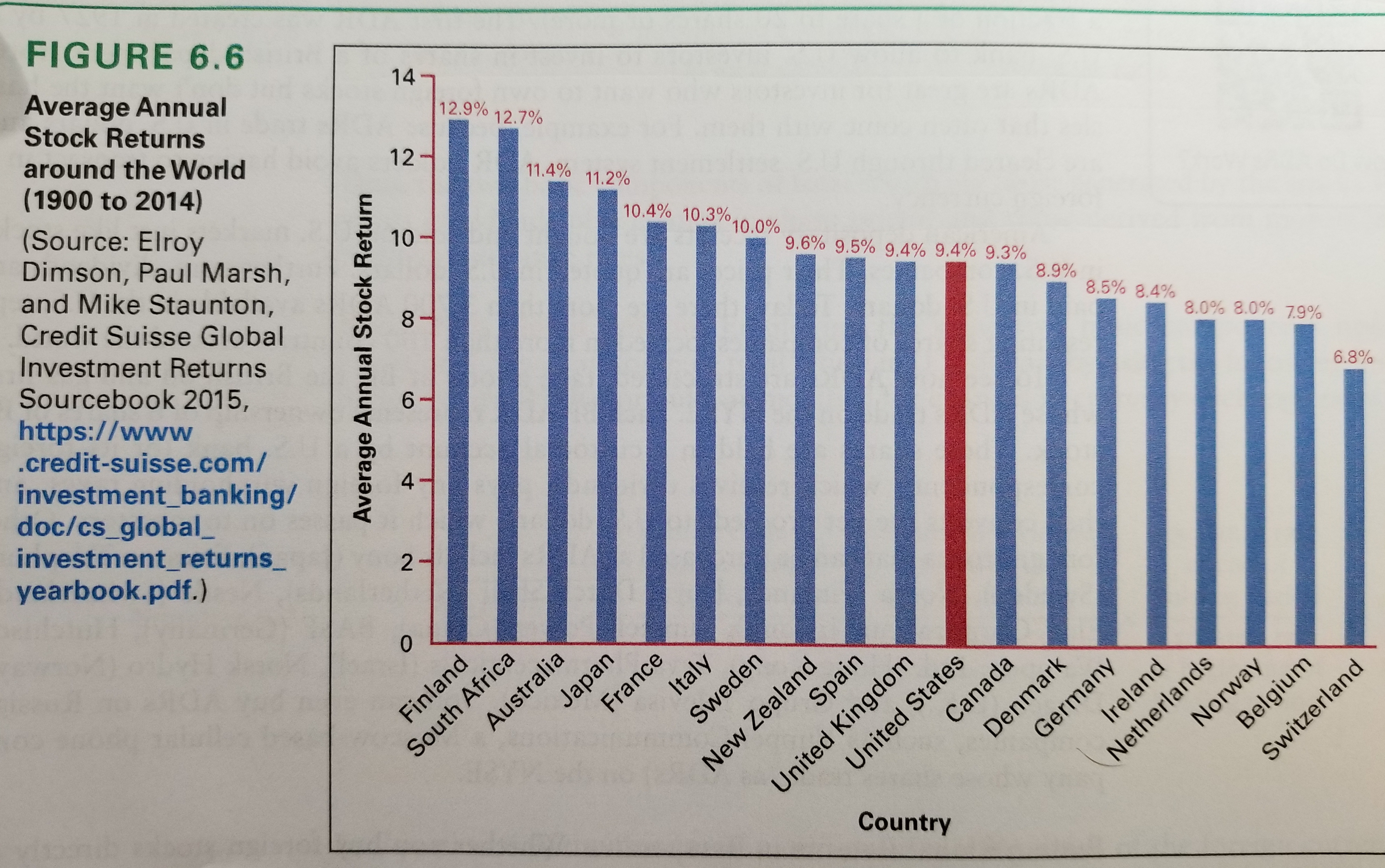

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns. As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market. When considering foreign equities, which are the…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 1)

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** When designing portfolios, one of the primary issues is defining, measuring, and allocating risk. The traditional approach to risk management separates risks into two worlds: systematic and unsystematic risk. What exactly do these risks entail? Systematic risks are risks that investors accept by simply investing in the system. In other words, these are market risks that cannot be diversified away. Systematic risks include such negative events as wars, natural disasters, and other similar unexpected events. If you’ve ever heard of the term Beta,…

-

Factors That Impact Credit Scores

Will opening a new line of credit help or hurt one’s credit score? How much of available credit should be utilized? Will credit inquiries negatively affect one’s score? There seems to be a lot of confusion around credit scores, as a recent Transunion survey suggests: 43% of consumers believe checking their credit score has the same effect as when a lender checks it and 44% of consumers believe marital status is factored. As such, let’s clarify the factors that actually affect FICO credit scores. Each of the following percentages represent how important each category is in generating a credit score: 35% payment history. 30% amounts owed. 15% length of credit…