“Weekend Content for New Financial Planners” is a collection of podcasts, articles, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. This installment begins with two articles from New Planner Recruiting’s co-founder Caleb Moore. Moore provides tips on how to handle a downmarket for both job seekers and firms (as a new advisor or career-changer, “seeing” the employer’s perspective can be especially helpful). Given the turbulent markets amid the pandemic, we next look at a couple of investing-related articles. The first comes from The Wall Street Journal’s Jason Zweig covering how the market collapse and economic slowdown affect the human brain (relevant,…

-

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 2)

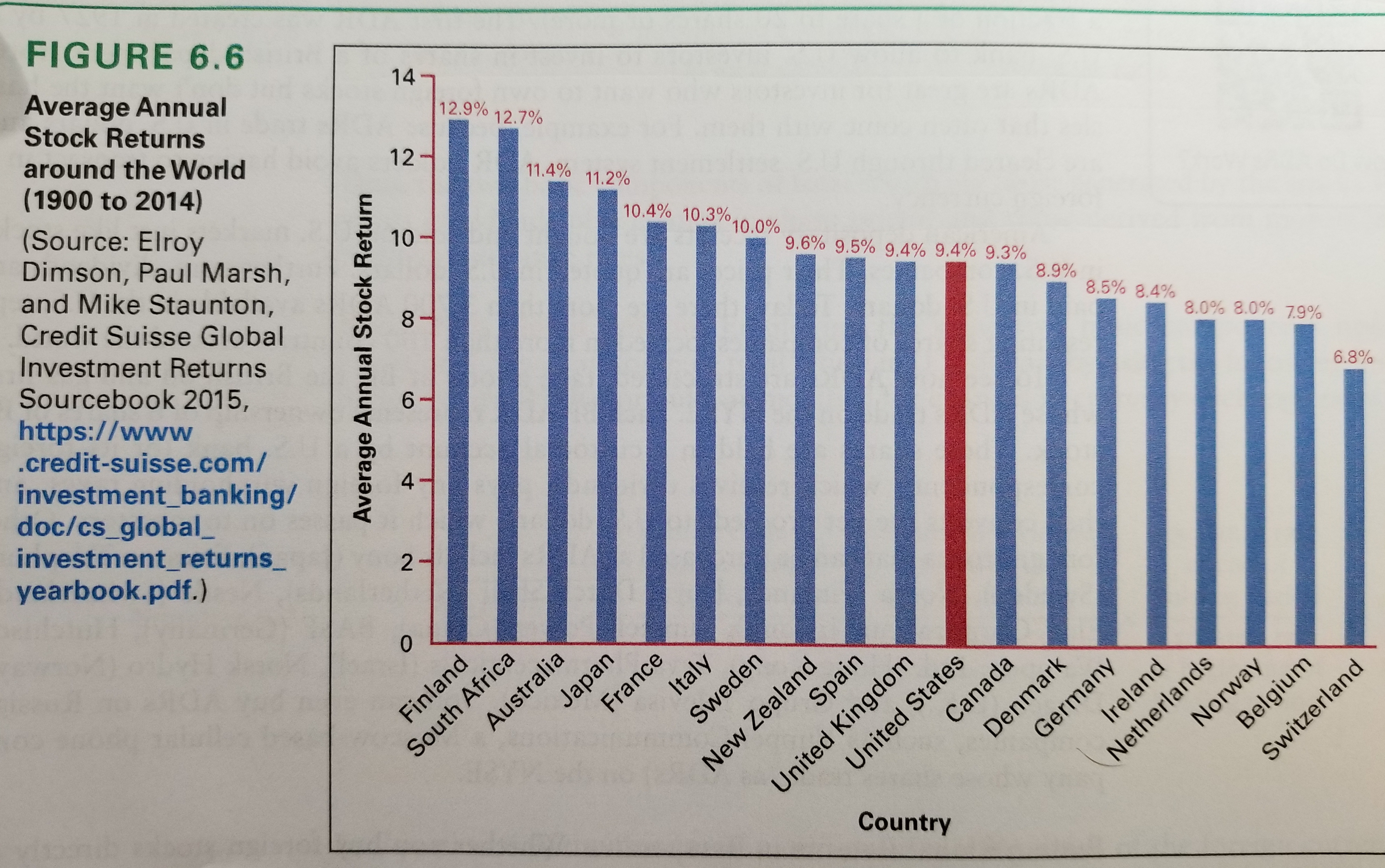

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns. As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market. When considering foreign equities, which are the…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 1)

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** When designing portfolios, one of the primary issues is defining, measuring, and allocating risk. The traditional approach to risk management separates risks into two worlds: systematic and unsystematic risk. What exactly do these risks entail? Systematic risks are risks that investors accept by simply investing in the system. In other words, these are market risks that cannot be diversified away. Systematic risks include such negative events as wars, natural disasters, and other similar unexpected events. If you’ve ever heard of the term Beta,…