“Weekend Content for New Financial Planners” is a collection of articles, podcasts, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. Deirdre Van Nest on the 3 stories every financial planner must share with prospective clients [Podcast]: “There’s that skepticism that’s already built in. Then you have to add in the fact that people are fearful of talking about money in general. It’s kind of a taboo subject. Many of us, myself included, were raised in households where you just don’t talk about that. That’s very private business. You don’t talk about that. So, there’s already sort of this hiding mentality around…

-

-

Weekend Content for New Financial Planners (June 5-6 2021)

“Weekend Content for New Financial Planners” is a collection of articles, podcasts, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. Brian Portnoy explains “funded contentment,” the happiness equation, and how he defines the modern advisor [Video: 14-minutes]: How To Use A Purpose-Based Financial Planning Approach / Grow Episode 46 [Dasarte Yarnway, Altruist] Lessons from growing to $100 AUM in 4 years [Twitter thread]: Lessons From The Past 4 Years [Kyle Moore, Quarry Hill] How to “humanize” the sales process by personalizing “cold” emails with minimal time investment [Podcast: 53-minutes]: “You’re talking about the great sales mystery of over qualifying versus under…

-

Weekend Content for New Financial Planners (January 31, 2020)

“Weekend Content for New Financial Planners” is a collection of podcasts, articles, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more. *** With the start of a new year (and decade!), it’s a good time to rebrand the “Financial Planning Articles” series. With many of my links featuring podcast episodes and videos, “Weekend Content for New Financial Planners” better describes the content that I share in this series. This edition appropriately kicks off with two podcast episodes geared towards transitioning into the industry. From FPA Activate, the first is an interview between Hannah Moore and XY Planning Network’s Financial Planning and Process…

-

The Need for Financial Planning: The New “QBI” Deduction

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** As we recently covered, the new tax law titled the Tax Cut Jobs Act brought in the most significant changes to tax planning in several decades. These big changes bring the need for advisor guidance in helping clients navigate the new rules. One of the more significant parts of the new law is a new deduction for business owners. Dubbed the Section 199A deduction, or QBI (Qualified Business Income) deduction, its purpose is to maintain the tax benefit (no double taxation) that certain…

-

The Need for Financial Planning: Tax Cut Jobs Act Guidance

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Since its passing in late 2017, you have probably heard of the Tax Cut Jobs Act (or TCJA). With tax season in full swing, you have probably seen it being mentioned even more frequently. But perhaps you’ve always had your tax professional handle all of your matters and aren’t really sure of the new law’s significance. As prospective financial planners, the passage of TCJA cannot be understated. Major changes to the tax law do not come around very frequently. The last? 1986 (!).…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 2)

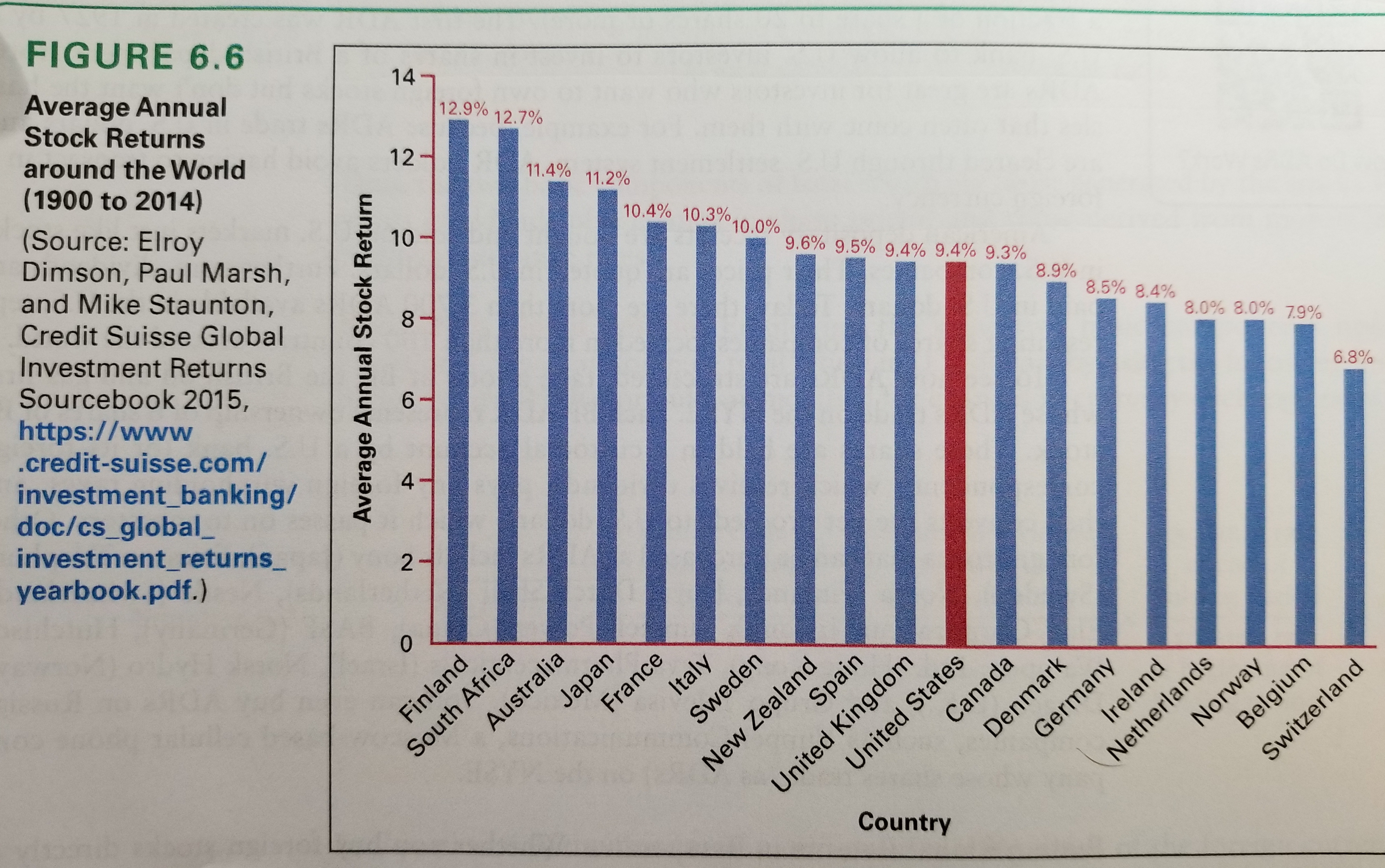

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns. As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market. When considering foreign equities, which are the…

-

Factors That Impact Credit Scores

Will opening a new line of credit help or hurt one’s credit score? How much of available credit should be utilized? Will credit inquiries negatively affect one’s score? There seems to be a lot of confusion around credit scores, as a recent Transunion survey suggests: 43% of consumers believe checking their credit score has the same effect as when a lender checks it and 44% of consumers believe marital status is factored. As such, let’s clarify the factors that actually affect FICO credit scores. Each of the following percentages represent how important each category is in generating a credit score: 35% payment history. 30% amounts owed. 15% length of credit…

-

Discussion Questions: Insurance, Chapter 2 “Characteristics of Insurance”

Discussion Questions: information relating to the end-of-chapter “Discussion Questions” from the financial planning coursework material through New York University’s CFP® Program (in conjunction with Dalton Education). Discussion Questions for Chapter 2: “Characteristics of Insurance” Describe the personal risk management process. Page 14: “Part of the ‘analyze and evaluate’ step in the financial planning process requires that a planner perform the risk management process. The risk management process includes the financial planner reviewing all of the client’s risk exposures and determining the appropriate risk management technique for each risk. The risk management process includes: Determining the objectives of the risk management program. Identifying the risks to which the individual is exposed. Evaluating…

-

Financial Planning Articles (August 26, 2018)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning. What I’m Reading: When A Good Offer For A First Financial Advisor Job Really Isn’t (Michael Kitces, Kitces.com) “The key point here is to understand that unfortunately, the financial advisor job offer from a lot of big firms is usually not a good way to start your career as a financial advisor because it’s not a financial advisor job, it’s a financial salesperson job, regardless of what it says on your business card.” ‘Super Robos’ to emerge as digital financial advice evolves (Sean Allocca, Financial-Planning.com) “A super robo would expand far beyond investments to…

-

Fundamentals Chapter 3 Discussion Questions: “Financial Planning Approaches: Analysis and Recommendations”

Discussion Questions: information relating to the end-of-chapter “Discussion Questions” from the financial planning coursework material through New York University’s CFP® Program (in conjunction with Dalton Education). Discussion Questions for Chapter 3: “Financial Planning Approaches: Analysis and Recommendations” List and define the eight approaches to financial planning analysis and recommendations. Life Cycle approach: Quick data collection; planner gets a brief overview to facilitate a focused first conversation. Usually used early in engagement. Framework based on the idea that client’s age may indicate the life phase: Asset accumulation phase: usually early 20’s until late 50’s when discretionary CF for investing is low and debt-to-net worth is high. Conservation (risk management) phase: usually beings…