“Book Notes” is a collection of notes from books relevant to entering the industry and practicing financial planning. *** Note: For a series introduction and an explanation of my interest in the book, check out this page with my notes on the first three chapters. *** Chapter 13: Massive Action In Chapter 13, Cardone introduces his 10X principle which has become one of his core principles. He begins the chapter by opining that most people underestimate the amount of work it takes to reach their goals. Next, he describes his view on four different types of action. He goes on to note the benefits of taking massive action and to…

-

-

Book Notes: “Sell Or Be Sold,” by Grant Cardone — Chapters 10 through 12.

“Book Notes” is a collection of notes from books relevant to entering the industry and practicing financial planning. *** Note: For a series introduction and an explanation of my interest in the book, check out this page with my notes on the first three chapters. *** Chapter 10: Establishing Trust Cardone begins this chapter by reminding readers of the skepticism buyers typically feel towards salespeople – and whose responsibility it is to handle that distrust to make the sale. He goes on to explain when individuals should address the trust issue and his preferred way to increase credibility. “Distrust in the sales cycle is not the buyer’s problem, but yours!”…

-

Book Notes: “Sell Or Be Sold,” by Grant Cardone — Chapters 7 through 9.

“Book Notes” is a collection of notes from books relevant to entering the industry and practicing financial planning. *** Note: For a series introduction and an explanation of my interest in the book, check out this page with my notes on the first three chapters. *** Chapter 7: Your Buyer’s Money This chapter touches on the assumptions salespeople make about the availability of money, the buyer’s willingness to spend, and reasons buyers buy complementary or add-on products. There is an especially large amount of “fluff” and writing in absolutes in this chapter. The main helpful takeaway is to not assume your own personal buying tendencies (how easily you part with…

-

Book Notes: “Sell Or Be Sold,” by Grant Cardone — Chapters 4 through 6.

“Book Notes” is a collection of notes from books relevant to entering the industry and practicing financial planning. *** Note: For a series introduction and an explanation of my interest in the book, check out this page with my notes on the first three chapters. *** Chapter 4: The Greats After Cardone contrasts professionals and amateurs in Chapter 3, he uses Chapter 4 to explain the importance of commitment, why looking for “greener pastures” is a recipe for failure, how commitment can lead to predicting outcomes, an alternative explanation for why people don’t like sales (other than rejection), and what makes a truly great salesperson: “Commit: to devote oneself completely…

-

Book Notes: “Sell or Be Sold,” by Grant Cardone — Chapters 1 through 3.

“Book Notes” is a collection of notes from books relevant to entering the industry and practicing financial planning. *** Series introductory note: As the first post in the “Book Notes” series, I thought I would take a moment to explain the rationale behind the series. When entering the industry, you have probably come across various book recommendations from a variety of professionals you respect. Similarly, I have come across several books that meet the same criteria. As such, I thought I would share some of the notes from these books that may be helpful on their own and/or serve as a catalyst for you to pick up the book and…

-

Financial Planning Articles (June 24, 2019)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning, industry trends, career development, and more. *** This installment of Financial Planning Articles starts with two investment-related articles that go against conventional wisdom. The first features Michael Kitces and his findings that increasing equity exposure at retirement, rather than decreasing, is warranted. The second touches on the idea that effectiveness rather than efficiency is sometimes justified with portfolio construction and in many other areas of finance. We then move to three articles centered around Generation Y and Z. The first takes a look at how colleges and soon-to-be graduates are responding to the…

-

The Need for Financial Planning: The New “QBI” Deduction

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** As we recently covered, the new tax law titled the Tax Cut Jobs Act brought in the most significant changes to tax planning in several decades. These big changes bring the need for advisor guidance in helping clients navigate the new rules. One of the more significant parts of the new law is a new deduction for business owners. Dubbed the Section 199A deduction, or QBI (Qualified Business Income) deduction, its purpose is to maintain the tax benefit (no double taxation) that certain…

-

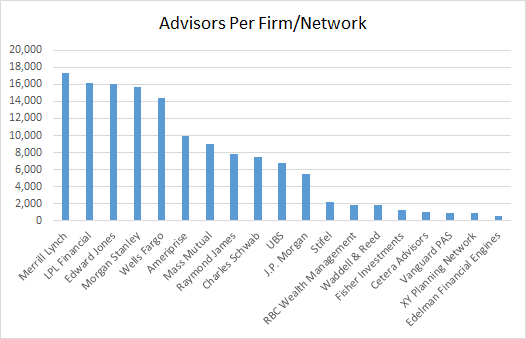

Industry Insights: Industry Players by Advisor Headcount

“Industry Insights” covers trends and topics within the financial planning industry. *** When first starting out in the industry, you may be curious about which firms are the dominant players. Sure, you are probably familiar with the big names like Merrill Lynch and Wells Fargo, but quantifying their role – and impact – in the market is a bit different. There are a variety of ways to measure market position, of course. Today we look at how firms stack up by advisor headcount. Total advisor estimates vary rather widely. Cerulli Associates estimates there are around 300,000 financial advisors in the United States. Michael Kitces recently explained why this figure is…

-

Financial Planning Articles (March 30, 2019)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning, industry trends, career development, and more. *** This edition begins with two articles covering today’s client preferences and industry trends. The first provides more data points showing clients prefer technology to complement, rather than replace, human financial advice. The second suggests Schwab is positioning itself well for this dynamic, announcing this week a new version of its robo-advisor platform on a monthly, subscription-fee basis. The next two articles center around advisor marketing and public relations with the first highlighting all of the benefits of creating a client persona and how to develop one.…

-

The Need for Financial Planning: Tax Cut Jobs Act Guidance

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Since its passing in late 2017, you have probably heard of the Tax Cut Jobs Act (or TCJA). With tax season in full swing, you have probably seen it being mentioned even more frequently. But perhaps you’ve always had your tax professional handle all of your matters and aren’t really sure of the new law’s significance. As prospective financial planners, the passage of TCJA cannot be understated. Major changes to the tax law do not come around very frequently. The last? 1986 (!).…