“Weekend Content for New Financial Planners” is a collection of articles, podcasts, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more.

Financial Planner and FPA leader Hannah Moore’s story and her top advice for new financial planners:

“And I see that [isolation] in spades with younger planners. I talk to them all the time. Where they’re working at some big-name shop or broker-dealer or something, and they have no idea there’s a world outside of there. And so that’s isolation. They don’t know what else is out there.”

FASuccess Ep 183: Structuring Your Advisory Business To Manage Your Time And Fit Your Natural Strengths, with Hannah Moore (Michael Kitces, Kitces.com)

How to build relationships/network online amid the pandemic:

“How can you connect with colleagues, clients, and prospects in meaningful and productive ways when in-person interactions aren’t an option? If you’re struggling to translate some of your usual strategies for networking into a virtual reality, here are five best practices to help you get started.”

5 Strategies For Networking In A Virtual World (Kristine McManus, Commonwealth)

Leveraging LinkedIn to actually produce results:

“A contact strategy yielding almost a 40% response rate is excellent. When you bear in mind you don’t need to hire a marketing service and it can be done in your spare time, it’s even better.”

How I Made LinkedIn Worth The Effort (Bryce Sanders, ThinkAdvisor)

If time seems to be going faster or slower than normal:

“Arstila says the suppression of repetitive days is one reason that we may remember periods stuck at home as passing quickly. This same effect, he says, explains why retired people, who often have routine days, report that time flies by.”

Why Time Feels So Weird In 2020 (Feidling Cage, Reuters)

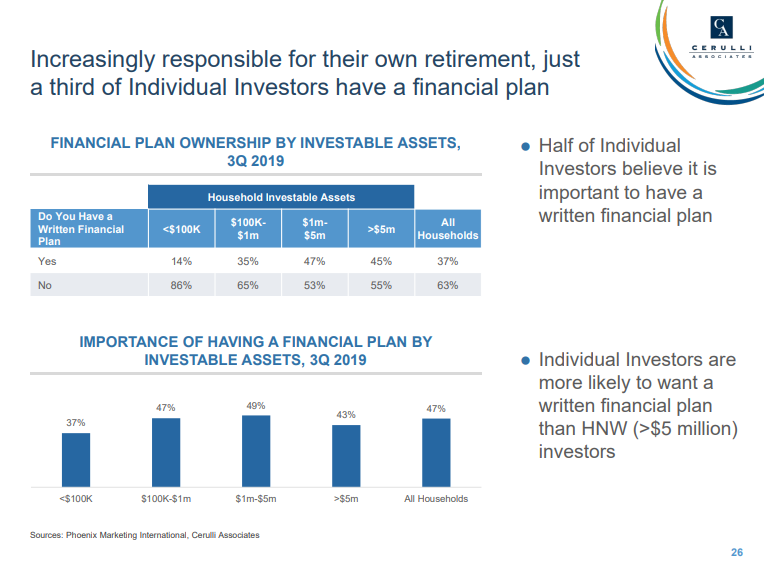

Recent Cerulli study (slide deck) details top financial priorities, preferences for a human (vs. robo) advisor, and more by AUM level (interesting look at the relatively neglected <$100k space):

SIFMA-Cerulli Individual Investor Project (SIFMA & Cerulli Associates)

What topic resonated with you? Comment below.

Follow me on social media for the latest updates: