“Weekend Content for New Financial Planners” is a collection of articles, podcasts, videos, etc. that I’ve been consuming regarding breaking into financial planning, industry trends, career development, and more.

WealthVoice founder Emily Binder on [Video or Podcast]:

- leveraging emerging technology to develop deeper client relationships and prospective client engagement while becoming more efficient

- the distinctions between branding versus sales and features versus benefits

- the importance of social media marketing and how to get started

How To Better Connect With Clients Through Emerging Technology [Dasarte Yarnway, The Human Advisor]

A framework for resetting client expectations (using delegating email as an example) [Podcast]:

“And so as with email and everything else, we need to be proactive in establishing expectations. When will I respond to emails? When should you email me versus calling me? All of these things are expectations that you can set and great news you can reset. So if you’re currently in the habit of your email dings and you immediately shoot back a reply, you’re going to need to reset that expectation. Great news, it can be done.

And just like you can reset an expectation, if you used to meet with clients five or six days a week and you had to reset that expectation down, it’s the same way. If you worked outside of traditional office hours, you’re working 7:00, 8:00 at night, and now you’re going to reset those expectations down. All of these things can be done successfully while delivering massive value.”

How To Delegate Email [Matt Jarvis & Micah Shilanski, The Perfect RIA]

The principles behind a persuasive response to prospect questions like “What’s going on in the markets?” [Article]:

“What continues to amaze us is how straightforward and fundamental critical sales abilities are, and how rarely they are properly taught and coached. The majority of these talents are common interpersonal skills like asking questions and listening.”

So, What’s Going On In The Markets? [Matt Oechsli, WealthManagement.com]

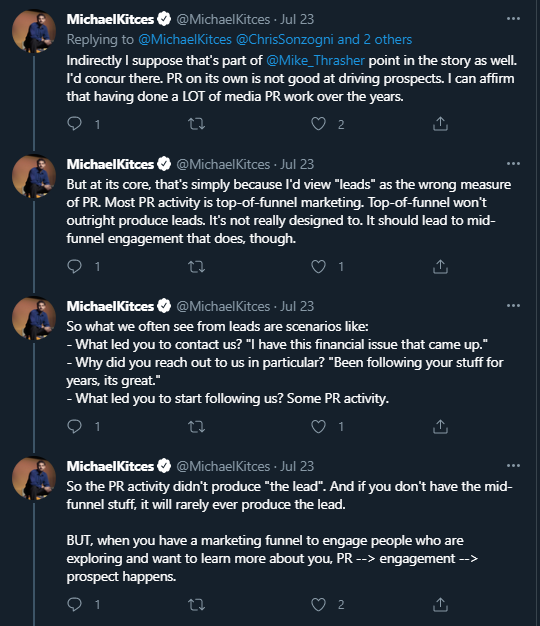

ICYMI: Michael Kitces’ thread on proper ROI expectations with media PR activities [Twitter thread]:

New Planner Recruiting’s Caleb Brown and Jesse Lineberry discuss compensation and benefits trends broken down by region [Podcast]:

“Where it’s vague, I think, is that 18-month to 3-years of experience candidate because we see from $60,000 to $85,000 for that candidate. So, I think there it is much more vague. It’s going to depend a great deal more on the actual experience you have. Do you have experience working with the financial planning softwares? Have you built a plan from start to finish? Are you in client meetings? If you are, are you participating in those meetings and presenting meaningful recommendations? I think that person might be on the upper end. I think if the experience is more the call center environment, more of the cold calling environment, it’s still going to be toward the lower side of that.”

Compensation Data Points For New Planners With Caleb Brown And Jesse Lineberry [Caleb Brown, New Planner Recruiting]

How to handle clients who are focused on beating the market [Article]:

“Clients are going to expect you to focus on performance. Portfolio reviews are similar to report cards in school. Ideally, you can position a fair method of performance measurement so you aren’t competing against an almost impossible standard.”

How You Measure Performance Is Crticial [Bryce Sanders, FA-Mag.com]

Which piece of content did you like? Comment below!

Follow me on social media for the latest updates: