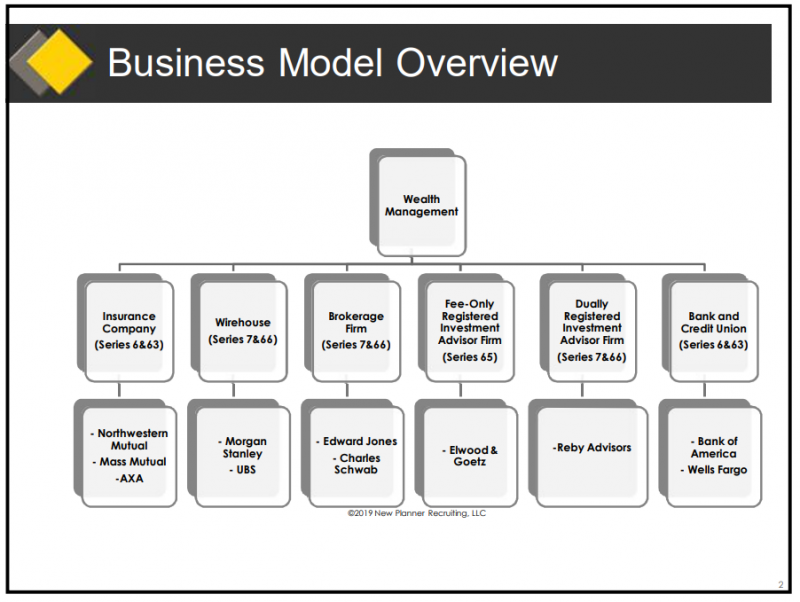

“Industry Insights” covers trends and topics within the financial planning industry. *** We continue our look at some of the fundamental aspects of the financial services industry. Last week, New Planner Recruiting hosted an informational webinar covering tips for getting hired as a new planner. One of the slides did a good job summarizing the industry’s business models while including some of the big-name firms within some of the models. In addition, the slide addresses a frequent source of confusion for many new to the industry – which licenses are needed for each model: While certain licenses may be better-known to industry newcomers, they may simply not be needed depending…

-

-

Financial Planning Articles (February 2, 2019)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning, industry trends, career development, and more. *** This edition begins with two articles on the topic of advisor value. The first, from Sarah Max with Barron’s, provides a recap of industry studies showing the significantly positive impact advisors continue to have on client finances. Michael Kitces and behavioral finance specialist Carl Richards continue the topic in their inaugural collaboration (of what may turn into a series) discussing the multiple sources of advisor value (while teasing how to frame value with clients). We then turn to a financial planning practice article on the growing…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 2)

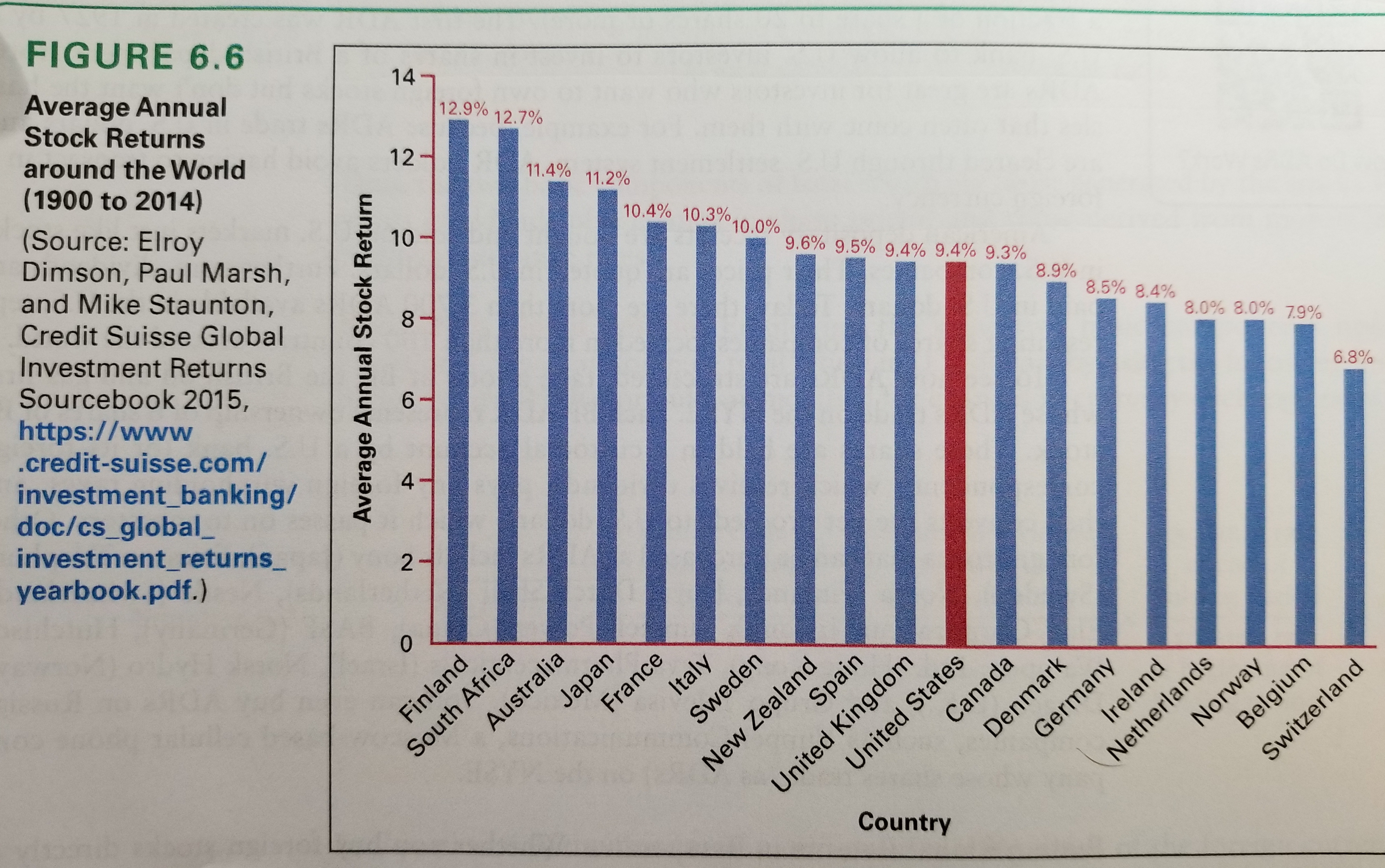

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** Continuing our look at systematic risk, unsystematic risk, and diversification, today we dive in a bit deeper to consider foreign equity markets and historical returns. As we mentioned in Part 1, investors tend to overallocate their equity positions to their home country (a tendency referred to as home-country bias). For example, we noted that U.S. investors allocate over 70% of their stock portfolio to U.S. stocks even though they only represent approximately 50% of the global stock market. When considering foreign equities, which are the…

-

Industry Insights: Differences Between Broker-Dealers and RIA Firms

“Industry Insights” covers trends and topics within the financial planning industry. *** It can be a challenge to understand the basic models of financial planning firms. Terms and acronyms like broker-dealers, IBDs, wirehouses, and RIAs can quickly become confusing. To add some clarity, let’s take a closer look at some key differences when considering the two primary models: broker-dealers and RIAs (Registered Investment Advisors). Broker-dealer is the term for entities that trade securities for their customers (brokering) or for their own account (dealing). Those who get their start with broker-dealers have to become registered representatives (through industry licensing). Registered representatives are paid on the basis of product commissions and must recommend…

-

Financial Planning Articles (January 11, 2019)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning, industry trends, career development, and more. *** This installment features a heavy dose of personal and career development articles from both Michael Kitces at Kitces.com and Shane Parrish at Farnam Street. Kitces explains why what may feel like “paying your dues” as a new advisor is really just a necessary aspect of learning the skills of the profession. His second article reviews strategies for satisfying the CFP Board experience requirements as a career changer. Parrish’s articles cover productivity (and doing less in order to do more) and learning how to learn and better…

-

The Need for Financial Planning: Two Types of Portfolio Risk (Part 1)

“The Need for Financial Planning” covers financial planning topics and ties in data suggesting the opportunity for new and prospective advisors to improve America’s financial health. *** When designing portfolios, one of the primary issues is defining, measuring, and allocating risk. The traditional approach to risk management separates risks into two worlds: systematic and unsystematic risk. What exactly do these risks entail? Systematic risks are risks that investors accept by simply investing in the system. In other words, these are market risks that cannot be diversified away. Systematic risks include such negative events as wars, natural disasters, and other similar unexpected events. If you’ve ever heard of the term Beta,…

-

Industry Insights: Stock Market Participation Rates

As I was continuing my Certified Financial Planning™ coursework to satisfy the CFP® education requirement, I came across an investing statistic I found interesting (and a bit concerning). Per Gallup’s annual Economic and Personal Finance survey, only 54% of U.S. adults report having money invested in stocks in some form (directly or through a fund). This figure was higher before the 2008 financial crisis – 62% – but that still seems low. For folks considering whether to enter financial planning (or financial coaching), this appears to be yet another data point showing that there is room for improvement.

-

Financial Planning Articles (December 29, 2018)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning. *** What I’m Reading: Planning Profession Robo Advisor Wealthfront Makes Automated Financial Planning Free (Anne Tergesen, The Wall Street Journal) “Among other things, Wealthfront’s financial planning service can tell clients how much they should save, how much they can afford to spend on a home, and how much to save for a child to attend college, using projections of future costs for specific U.S. schools along with estimates of the family’s financial aid. The service also assesses the impact of each financial decision on a client’s retirement plans.” Advisor Shortage? What Advisor Shortage? (Charles Paikert,…

-

Industry Insights: Employment Outlook for Financial Advisors

“Industry Insights” covers trends in the financial planning industry. *** As has been the case for several years now, the outlook for financial advisors appears rather favorable. According to the Occupational Outlook Handbook: “Employment of personal financial advisors is projected to grow 15 percent from 2016 to 2026, much faster than the average for all occupations…Job prospects for personal financial advisors should be relatively favorable, compared with prospects in other financial sector occupations. Those who obtain certification will likely have the best prospects.” Of course, the thought has been that robo-advisors will take some jobs. The OOH continues: “The emergence of “robo-advisors,” computer programs that provide automated investment advice based…

-

Financial Planning Articles (December 7, 2018)

“Financial Planning Articles” is a collection of articles and research that I’ve been reading regarding financial planning. *** What I’m Reading: Personal/Career Development Transitioning Part-Time Into Financial Planning As A Career Changer (Michael Kitces, Kitces.com) “I consequently often get this question, “Can I transition into being a financial advisor on a part-time basis as a career-changer?” For which I have to admit, I think the answer largely is no.” How To Email Someone You Haven’t Talked To In Forever (Rebecca Zucker, Harvard Business Review) “However, over the years, we often lose touch with people in our network as work, family, and other demands fill our limited time. As if reaching out to…